Table of Content

The State Bank of India partnered with five housing finance companies . These are PNB Housing Finance Ltd, Shriram Housing Finance Ltd, IIFL Home Finance Ltd, Capri Global Housing Finance Ltd and Edelweiss Housing Finance Ltd. This was done to provide affordable home loans to all small home buyers in India. On Wednesday, the country’s largest lender, State Bank of India raised the Benchmark Prime Lending Rate by 70 basis points (or 0.7 per cent) to 13.45 per cent.

Since it is also a debt, SBI takes into account the salary or income of the applicant before deciding the loan amount. There is also a facility to calculate the eligibility for a home or housing loan. You can use an eligibility calculator to calculate your home loan eligibility and check whether or not you can get the approval. The SBI Home Loan Amortisation schedule gives a monthly breakdown of the repayment process. The detailed amortisation schedule gives clarity to the borrower on the number of principal payments and interest rate that will be levied every month until the completion of the loan tenure.

Tata CapitalHome Loan

The Flexipay calculator allows you to calculate the EMI division that you pay during the home loan tenure. If the borrower has a floating rate home loan then, the change of benchmark repo rate will lead to a change in the interest rate of the loan and the corresponding EMI amount. SBI provides this home loan to both self-employed and salaried individuals. The age bracket to be eligible for this loan is from 18 to 70 years.

The online financial tool apprises the prospective borrower to be aware of the amount that is to be paid monthly to repay the entire loan. The use of the SBI home loan interest rate 2022 EMI calculator benefits the borrower as he is aware of the total cost of the loan and the monthly EMI. Likewise, it benefits SBI Bank as there will be lesser delayed payments and fewer defaults if the borrower makes a well-informed decision.

OFFERS

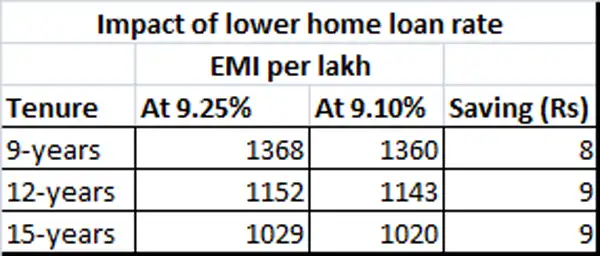

SBI has raised loan interest rates with effect from December 15, 2022. SBI easy home loan EMI calculator, by simply entering the loan amount, interest rate and select the loan tenure from drop down. The repayment tenure is up to 10 years, However, depending on your profile, age and income. You’ll also find a table below that’ll give you a brief on how the repayment process will work against your loan balance. The Interest rate also significantly impacts the monthly EMIs. If the interest rate on the home loan increases, it will add to the EMI and ultimately escalate the loan cost.

Calculate the remaining tenure to pay the outstanding balance- the borrower can use the outstanding balance of the loan to know how long they will have to pay the EMI to clear the debt. If the tenure still seems long, try transferring the outstanding loan balance to a different bank that allows repayment at lower rates. State Bank of India is a financial and banking service provider. These home loans can be attained for purchasing or constructing a property. Thus it is better to use an SBI Home Loan EMI Calculator to get a prior idea of how much the borrower will have to pay.

Loan against Property Interest Rates

SBI Home Loan EMI calculator results depend upon the values of loan principal, loan term, and rate of interest offered by SBI Bank on home loans. By entering the values of the three parameters in the SBI Bank home loan EMI formula, the borrower can gauge the corresponding EMI value. The result will also show the total interest component of the home loan.

The bank also has its own home loan EMI calculator to help you know the EMI. You do not have to pay any extra fees for making pre-payments or partial payments towards your loan amount. You can take extra home loan to construct the house after the plot is bought, and both the loans can be operated at the same time. You can repay your EMIs online with the help of Net banking. Although you are required to have an online SBI account to avail of this option. You can avail an additional interest rate concession of five basis points when applied from the YONO mobile application of the SBI.

Home Loan Eligibility for SBI

Under the Credit Linked Subsidy Scheme of this Yojana, first-time and eligible borrowers can avail subsidies on their home loan interest rate. Interest rate concession of 25 basis points would be provided to borrowers with more than 75 Lakhs home loans. It is to be noted that the interest rate concessions are directly linked to the applicants' credit scores. After the Reserve Bank of India raised the repo rate by 90 basis points to 4.90%, several banks have hiked their lending and deposit rates. The minimum interest rate on home loans has been increased by the State Bank of India . According to the SBI website, the bank's EBLR is 7.55% +CRP as on 15 June 2022.

This calculator for Home Loan EMI might require just a few key home loan details from the user to display results. You might have a loan amount, interest rate and tenure in mind but might be unsure about the EMI that you have to pay. Thus, the best tool that you need to use is the SBI’s EMI calculator, to help you choose the right loan amount, interest rate and also the tenure that you are comfortable with. A home loan is often a very large amount that you borrow from the bank, for the purpose of buying a home. The EMI also tends to be high and therefore you need to decide before hand how much an amount of loan you would want, what interest rate you are comfortable paying and also the tenure of the loan.

By clicking "Proceed" button, you will be redirected from SBI website to the resources located on servers maintained and operated by third parties. SBI doesn't take any responsibility for the images, pictures, plan, layout, size, cost, materials or any other contents in the said site. By clicking the "Proceed" button, you will be agreeing to the above. Privilege Home Loans is an exclusive home loan product for government employees whereas Shaurya Home Loan is for Defense Personals.

With floating rates, the interest rate of the home loan will change. If the repo rate increases, then both the interest rate and EMI will increase. Similarly, if the repo rate decreases, then the interest rate and EMI will also decrease.

No comments:

Post a Comment